|

Washington (UPI) Dec 21, 2006 A recent survey of top executives at pharmaceutical, biotech and medical device firms conducted by Deloitte reveals these companies will likely need to adopt dramatic changes in their business strategies between now and 2015 if they want to maintain their success. United Press International interviewed Jacques Mulder, one of the main authors of the report and a principal within Deloitte's life sciences and health care practice, about the changes ahead and what they mean for companies. Q: What are the major trends revealed in the survey? A: A couple of things stand out. Probably one of the most striking aspects to me was that companies expect that more than 50 percent of their revenues by 2015 will come from products and services they don't offer today. Think about that for a second. That's a pretty fundamental statement. And we could probably divide it into two pieces. The one being the drug-development pipeline is a long one and takes eight, 10, 12 years and therefore they may not be making money off the products that are in the market today, which is fair. It was the services piece that was actually interesting to me. And though we don't have exact items on this, I do think there are branded pharmaceutical companies that are starting to embrace genetics business. There are companies that are starting to diversify into partial ownership of treatment facilities. So in the future, not all revenues may come from sales of purely drugs or devices or biologics, but there may be other offerings, such as disease management or other services that go just beyond the supply of products. Q: Can you give examples of what companies might be engaged in these trends? A: We didn't get any detail out of the study, but as an example, Novartis about a year ago made a significant play and acquired a very strong generics business. Where five years ago, we had a distinction between biotech and pharmaceuticals, there's almost no major pharma company today that doesn't have a biologics portfolio. And the biologics companies like Amgen and Genentech specifically have announced they are getting into small-molecule chemistry programs. So there really is very little differentiation between biotech and pharma companies. We are seeing medical device companies starting to put drugs on devices, anti-infective coatings, anti-clotting agents like with the drug-eluting stents. We've seen some significant advances in the convergence between diagnostics and therapeutics. Companies are applying diagnostic tests, genotyping, phenotyping even, or using biomarkers to select patient populations that would be more responsive to certain therapies. So there are just a few of the examples. Q: Do you anticipate the convergence between biotech and pharma happening more and more? A: I definitely do. We do believe that, as we move closer to therapies that are more targeted ... and maybe ultimately on that continuum towards personalized medicine, we do see the major companies and smaller ones getting much, much closer together and leveraging technology and leveraging each other's science to bring products and new applications to market. We see a lot of activity here. Q: Do you think the trend of medical device companies applying drugs to their products will lead to them acquiring pharmaceutical companies or vice-versa? A: It could go both ways. We've already seen one or two larger device companies -- and device company may be the wrong word -- but GE acquired Amersham a couple of years back, which kind of gave us some guidance that they may not necessarily want to get into the mainstream pharmaceutical business, but there was definitely an application that they wanted to do in a combined fashion. I do think, though, that because there is such pressure on the research and development pipeline, there are really two trends that we have to keep our eye on. One is for device companies that want to put product onto their devices or to enhance their performance. They really don't have to deal with the scientific risk of the chemistry because that's been proven in the human body. So it almost becomes a new model of development. That is, I eliminate scientific risk, but I find different applications for a product that's been around for a while. In the case of drug-eluting stents sold by Boston Scientific, the drug used on that was paclitaxel, a cancer drug that's been on the market for 25 years. So they're starting to exploit side effects of products just because it's so tough to find a new chemical entity and bring it to market. People are trying to find different ways of using existing science. Q: What do you think the impact of these changing trends and models will be to companies? A: The trend to keep our eye on is, there is a very high level of alliance formation. Although we don't see from the report that we expect significant merger and acquisition activity, we expect more co-development and research alliances between small and larger companies. I think small and large companies are going to be moving much closer together and collaborating much more to get science out into the market -- and ultimately to the patient -- than we have in the past. I think it's not necessarily going to be acquisitions the way we have seen it for the past 10 years, but it's going to be much more of that collaborative alliance. Q: Looking out to 2015, if all these trends keep going, how do you think the landscape will look? A: There are a couple of things to consider. The first is the markets the major companies are focusing on, being North America, some of the major European countries and now, of course, with China and India and some of those markets really evolving and Africa, the foot print of activity globally is going to shift. I think the companies that will be successful by 2015 will be the ones that have been able to use and successfully leverage developing economies. Not just to get access to people because the war for talent is significant at this point in time. Where do we find the right scientists to be able to fuel and sustain our need for new research and new discoveries? Those markets will become global very, very quickly. There are significant benefits and we see pretty much all of the major companies making a play for utilizing science and also access to patients in some of the developing economies because there's real competition for finding trial subjects. In diabetes for instance, finding patients you can actually do clinical work on is becoming a competitive advantage. Expansion to new patient populations is important. And of course, companies that have the ability to adjust their business models in such a way that they can actually do profitable business in these developing environments will be ones that will be successful by 2015. We have to be reminded that 60 percent of the world's population has disease states that we currently treat aggressively and here in North America and Europe and some of the developed world. Sixty percent of those patients faced with those diseases are in developing countries. There's a huge market opportunity, but its going to require a different business model to be profitable. Community Email This Article Comment On This Article Related Links Hospital and Medical News at InternDaily.com Stem Cell News And Information The Clone Age - Cloning, Stem Cells, Space Medicine

Madison WI (SPX) Dec 19, 2006

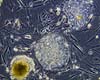

Madison WI (SPX) Dec 19, 2006Nothing in the cellular world is flat. Even the flattest of basement membranes has topography; bumps, if you like, beneath the cellular mattress. Unlike the princess kept awake by the pea, human embryonic stem (HES) cells do better when cultured on a substrate deliberately printed with nanoscale grooves and ridges, according to researchers from the University of Wisconsin-Madison. |

|

| The content herein, unless otherwise known to be public domain, are Copyright 1995-2006 - SpaceDaily.AFP and UPI Wire Stories are copyright Agence France-Presse and United Press International. ESA PortalReports are copyright European Space Agency. All NASA sourced material is public domain. Additionalcopyrights may apply in whole or part to other bona fide parties. Advertising does not imply endorsement,agreement or approval of any opinions, statements or information provided by SpaceDaily on any Web page published or hosted by SpaceDaily. Privacy Statement |